In today’s digital age, getting important documents like a PAN (Permanent Account Number) card is more streamlined than ever. The PAN card is a crucial identification document issued by the Income Tax Department of India, and it serves multiple purposes, including tax filing, financial transactions, and identity verification. Thanks to the online process, applying for a PAN card has become simple and hassle-free. This article will walk you through the step-by-step process of applying for a PAN card online.

What is a PAN Card and Why Do You Need It?

A PAN card contains a unique 10-character alphanumeric number and serves as a key identification tool for tax purposes. Here are a few reasons why you need a PAN card:

Income Tax Filing: PAN is mandatory for filing income tax returns.

Financial Transactions: It’s required for high-value financial transactions like buying property, investing in mutual funds, or opening a bank account.

Proof of Identity: A PAN card is widely accepted as proof of identity and age across India.

Now that we understand its significance, let’s dive into the process of applying for one online.

Step-by-Step Guide to Apply for a PAN Card Online

1. Choose the Right Platform

The Indian government has authorized two portals for applying for a PAN card online:

NSDL e-Governance: Apply via NSDL

UTIITSL Portal: Apply via UTIITSL

You can choose either portal to apply for your PAN card. Both sites offer similar services, so it’s a matter of personal preference.

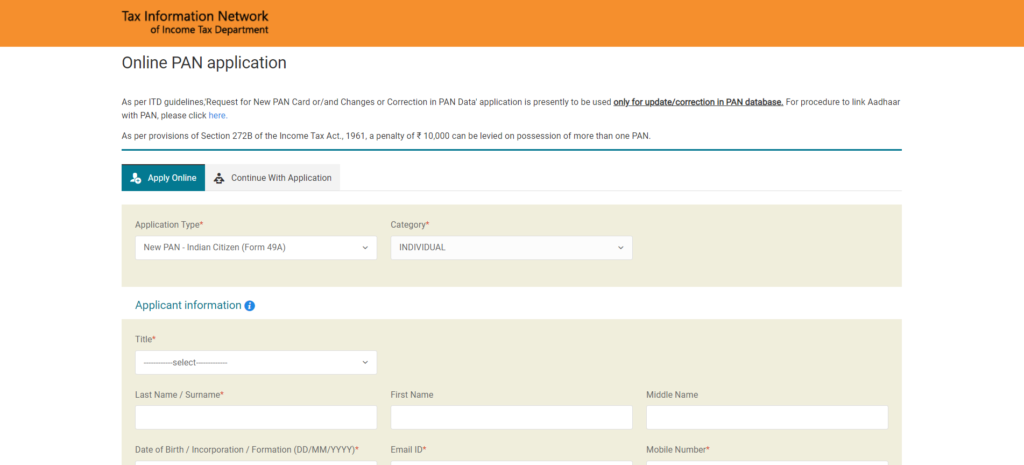

2. Select the Type of Application

Once on the chosen platform, you’ll need to select the appropriate form:

Form 49A: For Indian citizens applying for a new PAN card.

Form 49AA: For foreign citizens and NRIs (Non-Resident Indians).

Make sure to fill out the correct form based on your citizenship status.

3. Fill Out the PAN Application Form

Now it’s time to input your personal details, which include:

Full Name: Ensure it matches the name on your other documents.

Date of Birth: Accurate birth details as per your proof of birth.

Gender and Contact Details: Mobile number, email ID, and address.

Aadhaar Number: This is optional but recommended, as linking Aadhaar can speed up the verification process.

Make sure all the information is correct to avoid any delays or rejections in your application.

4. Upload Required Documents

To validate your application, you need to provide supporting documents. The required documents include:

Proof of Identity (POI): Aadhaar card, Voter ID, Passport, etc.

Proof of Address (POA): Aadhaar card, utility bills, driving license, etc.

Proof of Date of Birth: Birth certificate, school leaving certificate, or matriculation certificate.

Ensure that your documents are in the correct format (usually JPEG or PDF) and meet the specified size limits.

5. Make the Payment

Once your form is filled and documents uploaded, you need to make the payment:

For Indian Residents: INR 107

For Foreign Residents: INR 1,017

Payments can be made via credit/debit card, net banking, or through a demand draft. Once payment is confirmed, you’ll proceed to the next step.

6. Verification Process: Aadhaar e-KYC or Physical Submission

Aadhaar e-KYC: If your Aadhaar is linked to your mobile number, you can complete verification through an OTP sent to your phone. This is the quickest and easiest method.

Physical Submission: If you’re not using Aadhaar e-KYC, you’ll need to print the acknowledgment receipt, attach copies of your documents, and mail them to the address provided on the site.

7. Receive Your Acknowledgment Number

Once the form is submitted and payment is made, you’ll receive an acknowledgment number. This number allows you to track your PAN card application status. Make sure to keep it handy.

8. Delivery of PAN Card

Once your application is processed and verified, the PAN card will be dispatched to your registered address. You should receive it within 15-20 business days.

Benefits of Applying for a PAN Card Online

Convenience: You can apply for your PAN card from the comfort of your home.

Faster Processing: Aadhaar e-KYC significantly speeds up the process.

Trackable Process: The acknowledgment number allows you to check the status at any time.

Digital Copy: In many cases, you’ll receive a digitally signed PAN card (e-PAN) as soon as your application is approved, even before the physical card arrives.

Final Thoughts

Applying for a PAN card online is a quick, easy, and efficient process that saves time and effort. Whether you’re a salaried individual, business owner, or someone planning a major financial transaction, having a PAN card is essential in India. Follow the steps outlined above, and you’ll have your PAN card in no time.

If you encounter any challenges or have further questions, don’t hesitate to reach out to customer service via the NSDL or UTIITSL portals.

This guide aims to make the PAN application process easy for everyone, ensuring you get your card without any hiccups. Happy applying!